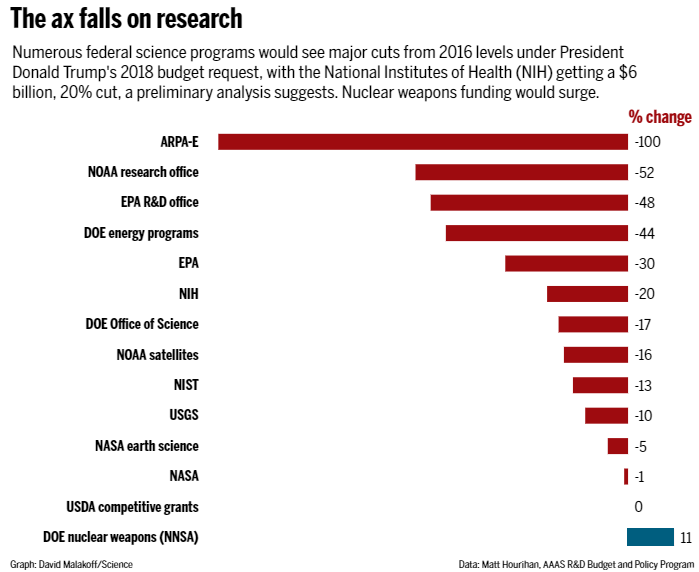

The impact of research funding cuts is already resonating throughout the U.S. innovation landscape. Recent federal funding freezes, particularly those affecting crucial programs at prestigious institutions like Harvard, threaten to stifle entrepreneurship and innovation across the startup ecosystem. Without adequate financial support, promising research in fields like biomedical science may stagnate, jeopardizing economic growth that relies heavily on these advancements. Experts suggest that even minimal cuts could lead to significant declines in gross domestic product, reminiscent of the financial turmoil witnessed during the 2008-2009 recession. As the fabric of research funding unravels, the future of startups and their contributions to the economy hangs in the balance, necessitating urgent discussions about the value of investment in scientific research and its far-reaching implications for society.

Research investment is the backbone of technological advancement and economic progress, and cuts to funding present a stark challenge to this system. The significant freeze on funding, especially at key research universities such as Harvard, poses a serious threat to the vitality of startups that typically emerge from innovative research and entrepreneurial education. As federal support diminishes, the momentum needed to drive entrepreneurship and technological breakthroughs could falter. The downstream effects of diminished research support extend beyond immediate funding concerns, impacting the foundation of the U.S. economy and its ability to thrive in a globally competitive landscape. Understanding these factors showcases the intricate link between academic research, federal investment, and the entrepreneurial landscape.

The Crucial Role of Research Funding in Innovation

Research funding plays a pivotal role in fostering innovation, particularly in the realms of science and technology. Institutions like Harvard rely heavily on both federal and private funding to support groundbreaking research initiatives. This funding enables researchers to explore new frontiers and develop solutions to some of society’s most pressing challenges. Without adequate financial resources, the pace of innovation can stagnate, causing a ripple effect throughout the economy. It’s evident that research funding impacts not only the potential discoveries but also the entrepreneurship and innovation landscape, highlighting its crucial importance to our economic future.

Moreover, the connection between research funding and the startup ecosystem cannot be overstated. Many startups emerge directly from university research initiatives, leveraging breakthroughs in areas such as biomedicine and engineering. For instance, the commercialization of academic research results in new technologies and products that stimulate economic growth. As startup creation often hinges on access to innovative ideas generated within research institutions, cuts to research funding threaten the potential for new entrepreneurial ventures that could significantly contribute to the economy.

Impact of Research Funding Cuts on Economic Growth

The recent cuts to research funding pose a substantial threat to U.S. economic growth, with projections indicating a significant GDP contraction if these funding issues persist. Notably, economists have warned that a reduction in funding, even if it constitutes just a fraction of total allocations, can have repercussions similar to those observed during the Great Recession. This economic downturn can stifle innovation, leading to fewer startups and reduced entrepreneurship activities—both crucial drivers of economic vitality and progress in society.

In the long term, the impact of these funding cuts extends beyond immediate economic metrics; it alters the landscape of American innovation. With less federal funding flowing into research facilities, the ability to cultivate future entrepreneurs becomes compromised. Institutions that historically have been incubators of talent and ideas may find themselves unable to maintain their status, leading to diminished prospects for new technologies and ventures that rely on cutting-edge research. This domino effect illustrates the importance of sustained research funding for the broader startup ecosystem and economy.

Repercussions for Startups and Entrepreneurship

The funding freeze at Harvard, and similar actions at other institutions, directly jeopardizes the pipeline that fuels the startup ecosystem. As universities serve as hotbeds for innovation, cuts in research funding can lead to delays in the development of new ideas that fuel the entrepreneurial spirit. Startups that traditionally thrive on cutting-edge research may find their foundations weakened, resulting in fewer launch-ready enterprises and lost opportunities for aspiring entrepreneurs to transform their concepts into viable businesses.

Moreover, the synergy between academia and startups is essential to economic dynamism; since many entrepreneurs emerge from university environments, a decline in funding translates to a lost generation of innovators. With fewer resources available for conducting vital research and fewer networking opportunities fostered through academic institutions, the entire ecosystem suffers. The perseverance of entrepreneurial initiatives is crucial to retaining the edge in global markets, and disruption caused by funding cuts can lead to significant long-term effects on entrepreneurship.

Navigating the Challenges of a Funding Freeze

Navigating the current landscape of research funding challenges requires a strategic approach, particularly with the ongoing federal funding freeze. Institutions must devise ways to attract alternative funding sources, such as private investors and philanthropic organizations. By diversifying funding streams, universities can mitigate the adverse effects of federal cuts and sustain their research missions. Alternative funding mechanisms may not only preserve existing projects but also allow for new initiatives that stimulate innovation and entrepreneurship.

Another important aspect is fostering partnerships between academia and the private sector. Collaborative ventures can enrich the research environment and provide critical resources that may be lacking due to reduced federal support. By closely aligning with industry needs, universities can enhance their research relevance and subsequently position their startup ecosystems to thrive despite the challenges presented by funding freezes.

Long-Term Impacts of Reduced Federal Funding

The long-term impacts of reduced federal funding for scientific research are yet to be fully realized, but early signs are concerning. As the flow of resources dwindles, the hiring freezes and termination of grants indicate a cooling of the entrepreneurial engine. Innovations that take years to materialize within university settings could be delayed or even abandoned, leading to a notable reduction in the number of promising startups entering the market. This trend suggests a troubling future where U.S. innovation capabilities are considerably weakened.

Furthermore, the halt of funding can create a brain drain as talented researchers and entrepreneurs opt for opportunities in countries with more favorable funding climates. This migration not only depletes U.S. research institutions of critical talent but also limits the potential global competitiveness of American startups. If this trend continues, the U.S. risks falling behind in the global race for technological leadership, emphasizing the need for a renewed commitment to research funding.

Revitalizing the Startup Ecosystem Through Policy Changes

To revitalize the startup ecosystem in light of diminished research funding, policymakers must recognize the critical link between federal investment in research and long-term economic growth. By addressing the funding freeze and advocating for increased investments in scientific research, the government can reinvigorate entrepreneurship and innovation. Policy changes that prioritize funding for research initiatives will create a more favorable environment for startups to flourish, ultimately benefiting the broader economy.

Additionally, supporting initiatives that bridge the gap between research and commercialization is essential. Programs that facilitate technology transfer from academic labs to the marketplace can enhance the viability of startups, ensuring that innovative ideas translate into economic opportunities. Strategies that encourage collaboration among universities, government, and industry stakeholders can strengthen the startup ecosystem and promote sustainable economic development.

The Future of Biomedical Research: Challenges and Opportunities

The future of biomedical research hinges significantly on the stability of funding sources. As federal funding comes under scrutiny, research institutions face an uncertain landscape that threatens their ability to conduct vital studies. Disruptions in funding may delay crucial advancements in healthcare, impacting patient outcomes and overall public health. The relationship between funding and the progress of medical innovations underscores how critical it is to maintain robust federal support for biomedical research.

However, amidst these challenges, opportunities for innovation also emerge. The current funding crisis can inspire new ideas in how biomedical research is conducted and financed. By developing alternative funding models—such as public-private partnerships or accelerated grant processes—researchers may find innovative pathways to sustain their work. This adaptability is vital in navigating financial uncertainties while continuing to foster breakthroughs in biomedical sciences that can profoundly impact society.

Entrepreneurship Education: Catalyzing Future Innovators

Entrepreneurship education is integral to nurturing future innovators, especially in an environment where research funding may fluctuate. Programs designed to empower students with the skills needed for successful startup creation not only bolster individual aspirations but can revitalize the entire economic ecosystem. Harvard Business School’s emphasis on entrepreneurship illustrates how educational institutions can serve as launchpads for budding entrepreneurs, encouraging them to translate their ideas into viable business endeavors.

Additionally, fostering a culture of entrepreneurship within academic settings encourages collaboration across disciplines, leading to increased creativity and innovation. Initiatives that combine technical training with business acumen prepare students to tackle complex challenges in the startup landscape. As they engage with real-world problems, these future innovators can drive the economy forward, proving that education is a powerful tool in combating the challenges posed by funding cuts.

Strategies for Resilience in the Face of Funding Cuts

In the face of research funding cuts, resilience becomes paramount for educational institutions and their associated startups. Developing adaptive strategies that allow researchers and entrepreneurs to thrive despite financial uncertainties is essential. Institutions can look into enhancing partnerships with local industries to provide support and resources that can supplement diminished federal funding. This collaborative approach not only encourages innovation but also strengthens the connections between research institutions and the local economy.

Moreover, leveraging technology and digital resources can open up new avenues for fundraising and collaboration. Crowdfunding campaigns, virtual incubator programs, and online collaboration platforms can bridge the gaps left by funding cuts, allowing innovative ideas to still find support. By being proactive and seeking alternative pathways, universities and startups can navigate through financial hardships while continuing to contribute valuable research and entrepreneurial initiatives to the market.

Frequently Asked Questions

What are the potential impacts of research funding cuts on the startup ecosystem?

Cuts to research funding can severely disrupt the startup ecosystem by limiting the resources available for innovation and technological development. With less federal funding, research universities may produce fewer groundbreaking ideas, which are crucial for the formation of successful startups in fields like technology and biomedicine. As a result, the overall growth of the entrepreneurship landscape may stagnate, leading to fewer new companies and innovations in the marketplace.

How does a federal funding freeze affect federal biomedical research and economic growth?

A federal funding freeze can halt vital biomedical research, leading to a decline in innovation and discovery. Research investments typically yield a significant return, with studies indicating that for every dollar invested in biomedical research, the U.S. sees a substantial increase in economic activity. Without consistent research funding, we could witness a contraction in the economy, similar to the impacts experienced during the Great Recession.

In what ways can cuts to Harvard research funding impact innovation and entrepreneurship?

Cuts to Harvard research funding can limit the lab resources necessary for producing innovative technologies and entrepreneurial ventures. Researchers and students rely on access to funding for projects that can lead to startups. Without financial support, valuable research may not progress, hindering the education and training of future entrepreneurs who innovate within the startup ecosystem.

What are the economic implications of disrupted research funding for startups?

Disrupted research funding can lead to a decrease in the number of successful startups emerging from research universities. As the pipeline for new ideas and technology innovations slows, the U.S. economy may face stagnation, affecting job creation and technological advancement. A lack of startup formation can hinder overall economic growth and innovation.

How does entrepreneurship and innovation rely on research funding?

Entrepreneurship and innovation heavily depend on research funding, as it fuels the development of new ideas and technologies. Access to robust funding enables researchers to explore and refine innovative concepts, which can then be commercialized into new products and services. When research funding is cut, it can lead to a decline in the quality and quantity of innovations entering the startup ecosystem.

What role does federal funding play in the success of tech and biomedical startups?

Federal funding is essential for the success of tech and biomedical startups, as it provides the necessary financial resources for research and development. This funding supports the initial stages of innovation, allowing researchers to create and develop technologies that become the foundation for new enterprises. The success of these startups often hinges on the availability of consistent and adequate research funding.

How long could it take to see the full effects of cuts to research funding on entrepreneurship?

The full effects of cuts to research funding on entrepreneurship may take one to three years to manifest. Since the process of transforming research ideas into commercially viable startups can be lengthy, the ripple effects of funding disruptions will likely unfold over an extended timeframe, impacting the future landscape of innovation and entrepreneurship.

| Key Point | Details |

|---|---|

| Impact of Funding Cuts | Over $9 billion in Harvard research funding under review, with a potential GDP shrinkage of 3.8%. |

| Role of Research Universities | They serve as incubators for startups, nurturing innovation through faculty research and student entrepreneurship. |

| Effects on Startups | Funding freezes lead to hiring freezes, canceled initiatives, and a projected decrease in promising startups. |

| Long-term Consequences | The damage from funding cuts may take 1-3 years to manifest fully, with fewer successful startups emerging. |

Summary

The impact of research funding cuts is significant and poses a critical threat to U.S. innovation. As federal funding for scientific research is frozen, the ripple effects are beginning to disrupt the pipeline of startups essential for economic growth. Educational institutions like Harvard not only drive innovation through their research initiatives but also serve as fertile ground for budding entrepreneurs. Without adequate funding, the ecosystem that fosters these critical startups is at risk, potentially leading to long-term declines in economic productivity and technological advancement.